12 May Is Your Life Insured?

In honor of Mother’s Day this month, I want to talk about the importance of life insurance for parents.

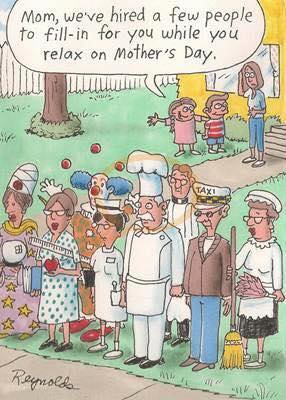

I believe one of the best gifts you can give your loved ones is to protect them financially if they depend on you for financial support. Life insurance proceeds allow the surviving family members to be taken care of financially, while they’re emotionally grieving the loss of a mother, father, or spouse. A common myth is that only parents with traditional incomes need life insurance. If a stay-at-home-parent were to suddenly pass away, you would have a hard time filling their shoes. Imagine trying to hire a chef, a nanny, a housekeeper, and a chauffeur just to help your family get through their daily activities. It sounds overwhelming, doesn’t it?

I have good news for you from a financial planning standpoint. Life insurance will protect your family from financial hardships if a parent suddenly passes away. Please understand, money doesn’t replace a loved one. However, it’s certainly best to not also be financially devastated at the same time that you’re grieving. Having financial stability for you family will give them the gift of time to figure out their new normal, and what the next step will be in moving forward with life.

Term life Insurance is the most common type of life insurance. This type of insurance doesn’t maintain any cash value inside of the policy. The premiums, or the cost of insurance, are guaranteed not to rise during the fixed term of the policy. This type of insurance is the least expensive way to insure your life in order to protect your loved ones.

Example: If you own a $1 million 20–year level term life insurance policy, the premium is locked in for exactly 20 years. The policy won’t lapse during this time period unless you don’t pay your premiums. At the end of 20 years, the premiums will most likely sky-rocket in cost. The goal is to not need any life insurance by the time the fixed term of the policy is reached.

Whole Life insurance policies are hybrid products. This type of insurance has a cash value account that grows inside of the policy, in addition to the death benefit. The cash value inside of the insurance policy can be used for a variety of liquidity needs. Another benefit of a whole life insurance policy is that it has no fixed term. The premiums are locked in for the life of the insured person, as long as the premiums are paid on time.

I’m often asked, “Emily, how much life insurance do I need?” I always respond: “It depends on your unique situation.” There is a basic way to figure out how much life insurance you need. Multiply your annual income by the number of years you want to provide for your loved ones, if you pass away. Then add in the balance owed on any debt you currently have, such as a mortgage or car payment.

Example 1: A husband who makes $100,000 annually has a wife and a 1 year-old daughter. If he were to pass away today, he wants to make sure his wife and daughter are supported financially until the daughter is 21 years of age. The family also currently has a $200,000 balance on their home mortgage. I would recommend that he needs at least $2.2 million of life insurance. ($100,000 *20 years = $2 million) + ($200,000 to pay off the mortgage at the insured’s death)

Example 2: A stay-at-home mom takes care of her children and her household while her husband works outside of the home, to support their family financially. If she were to unexpectedly pass away, it would probably cost around $50,000 per year to replace her workload with staff members. It would be best to make sure she has life insurance to cover the cost of her workload until her youngest child is self-sufficient. You can use the same formula shown in Example 1, with different variables, to determine how much life insurance she needs.

The cost of life insurance is based on the insured’s age at the time of application and their medical background. Unfortunately, the older we become, the more health issues we may have. As a result, we all become more expensive to insure as we age. In some cases, people wait too long to apply for life insurance and they find out when it’s too late that they’re uninsurable. This occurs when a life insurance company has analyzed the applicant’s situation and believes the applicant is too risky to insure.

Friend, please know that the cost of life insurance NEVER gets any cheaper if you wait to apply until you believe it’s affordable. We all get older every day and our health is not guaranteed tomorrow. Anyone can become uninsurable from a medical standpoint over night with no warning. I don’t want to scare you. I do however want to encourage you to stop procrastinating and apply for life insurance if you haven’t already done so.

Your age and your health TODAY are the only things you can guarantee. Please make sure your loved ones are protected financially if you were to ever pass away, before they’re financially independent. Remember, they’re counting on you!